What Is Smart AI Payroll Automation?

Defining AI Payroll Automation in 2025

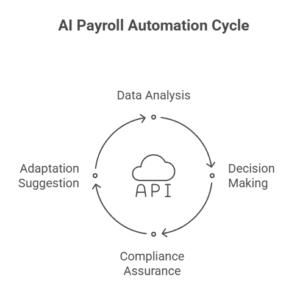

AI Payroll automation involves the use of software to manage and perform wage functions such as salary calculation, deductions, tax submission and direct deposits. In 2025, it has evolved in intelligent systems run by artificial intelligence and machine learning, capable of dynamic decision -making and historical data.

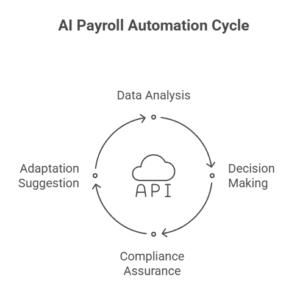

The Role of AI and Machine Learning in Modern Payroll Tools

AI is revolutionizing how payroll is handled by decision-making processes and improving data accuracy. Machine Learning (ML) analyzes your payroll data to detect nonconformities, ensure compliance and suggest adaptation – without manual intervention requirements.

Manual Payroll Challenges Businesses Face

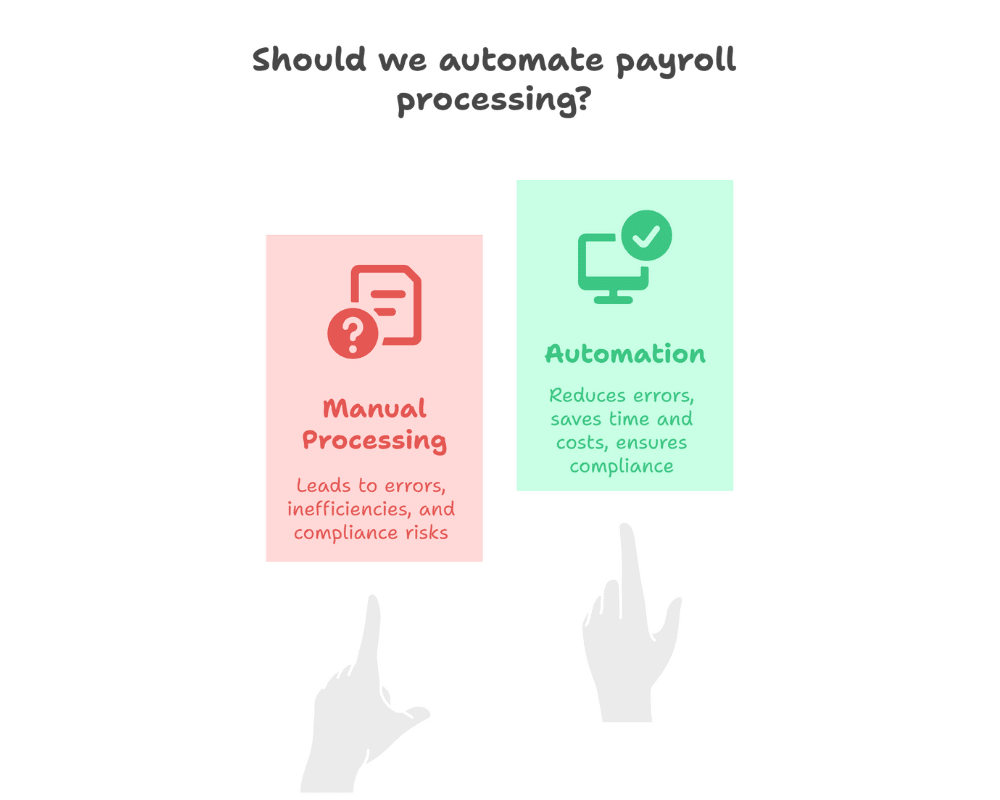

Common Errors in Manual Payroll Processing

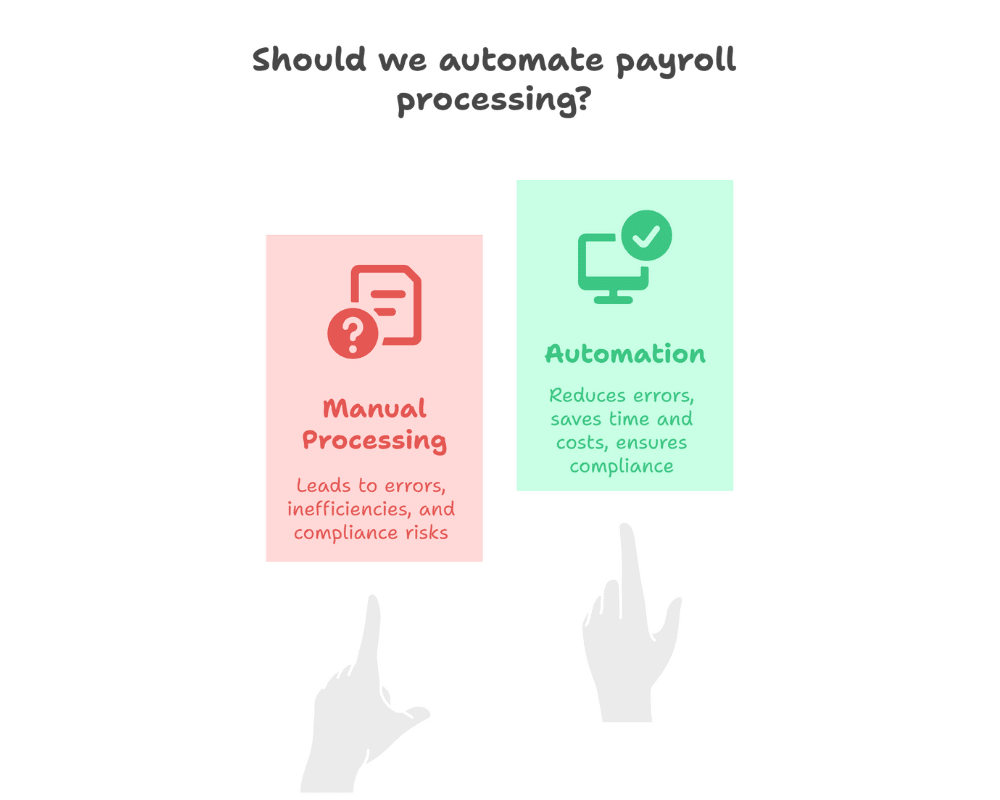

Manual treatment often leads to errors in wage calculation, tax submission and profit distribution. These errors can affect both money and reliability for companies.

Time and Cost Inefficiencies

Traditional wage methods are labour-intensive, which requires hours of manual entry and verification. Automation of these stages significantly cuts down operating time and reduces the cost of overhead.

Compliance and Legal Risks

Non-compliance with labor laws or incorrect tax submissions can result in hefty penalties. Payroll automation ensures all tasks are executed in line with current legislation, especially in regions like the UAE.

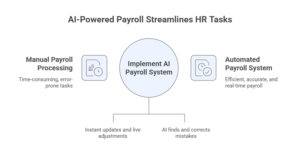

How AI-Powered Payroll Automation Reduces Manual Work

Automating Routine Tasks Like Tax, Attendance, and Payslips

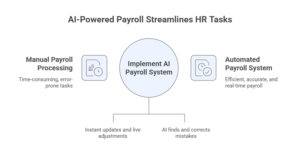

Automated payroll solutions free up HR personnel to work on strategic projects by precisely and swiftly handling monotonous tasks like creating wages, tracking attendance, and calculating compensation.

Real-Time Data Processing and Accuracy

With AI-driven tools, payroll processes become more efficient, accurate and real-time, allowing for instant updates and adjustments based on live data.

Intelligent Error Detection and Auto-Corrections

Artificial intelligence can find mistakes or unusual patterns in payroll data. It can also make automatic corrections. This reduces the need for human involvement and lowers risks.

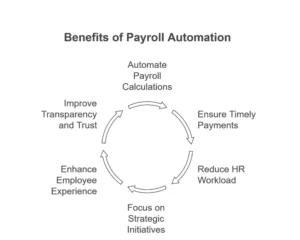

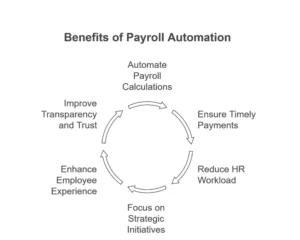

Key Benefits for Growing Businesses

Faster Payroll Processing

Automating payroll calculations saves time. It also allows salary payments to happen on time, even for large teams.

Reduced HR Workload and Increased Focus on Strategy

By automating administrative payroll tasks, HR teams can focus more on employee engagement, recruitment, and development strategies.

Better Employee Experience and Self-Service

Employees can enjoy real-time access to payment, tax posts and leave balances through the integrated self-service portal, improving openness and trust.

Integration and Scalability of AI Payroll Systems

Seamless Integration with HR and Accounting Software

Modern automated payroll solutions can be integrated with different software platforms, including HRM, ERP and financial equipment, enabling data consistency across various departments.

Scalable Solutions for Teams of Any Size

Whether you’re paying for 10 or 10,000 employees, AI-powered payroll platforms expand with your company’s growth without compromising performance.

Ensuring Compliance and Security with Smart Payroll

Built-in Legal Compliance

Smart wage systems have been established with local labour laws. For the UAE companies, compliance with WPS (salary security system) is secured in software to prevent legal violations.

Enhanced Data Privacy and Role-Based Access

The AI-supported platform comes with encryption, role-based access control and audit paths, and ensures data security and responsibility at each stage.

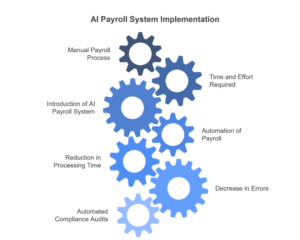

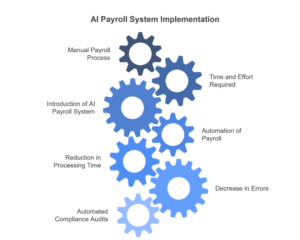

Real-World Example: AI Payroll in UAE Companies

Before and After Automation

A mid-sized UAE retail firm once moved pay for its two hundred staff by hand, and three HR folks needed five full days each month. When it switched to automated payroll with modern HR tech, the same task now takes one person a couple of hours, and mistakes have dropped to almost nothing.

Measurable Time and Cost Savings

Payroll errors dropped by 90%, processing time reduced by 75%, and compliance audits became fully automated.

Choosing the Right Payroll Automation Platform

Features to Look for in AI-Powered Solutions

The AI-operated solutions have many key functions, including automatic tax management, integrated time monitoring, autonomous platforms, live data reports and compliance updates.

Questions to Ask Vendors

How does your platform ensure compliance with UAE labor laws?

Is your software scalable as my company grows?

What AI capabilities are integrated, and how do they learn from data?

FAQ

What is smart payroll automation?

AI-operated equipment is used to automate payroll functions such as wage counting, attendance tracking, and regulatory compliance.

How does AI reduce manual work in payroll?

AI reduces manual work by automatically detecting recurring tasks, identifying irregularities and increasing data accuracy so that HR can focus on strategic functions.

Is payroll automation secure for UAE companies?

Yes, with features like encrypted storage, role-based access, and WPS compliance, these systems are built for security and local regulation.